“You’re a hero if you just show up”: Joe Pettit on Polka Dot Dairy’s next chapter in Hastings, Minnesota

Joe Pettit is a co-owner of Polka Dot Dairy, a family-run distributor based in Hastings, Minnesota.

In Hastings, Minnesota, the most important work often happens before most people are fully awake.

A back door opens. A cooler hums. A freezer door seals shut. A case gets rotated. A shelf gets faced. And a store that serves the town—its commuters, lake-weekend traffic, school families, shift workers, and Sunday regulars—keeps running without drama.

That’s the world Polka Dot Dairy has lived in for decades: the quiet, high-stakes business of showing up. On paper, it’s distribution. In real life, it’s trust—earned by doing the unglamorous things consistently, especially when the industry around you is shifting.

Polka Dot Dairy was formed in 1956, and the company has long described its foundation as “high quality dairy products sold at fair prices, delivered with outstanding service.” That sentence matters now more than ever—because the next chapter isn’t about abandoning Polka Dot’s identity. It’s about translating that identity into a new operating reality.

In a recent interview, co-owner Joe Pettit spoke with rare candor about what’s changing, what’s staying, and what Polka Dot Dairy wants to become as it pivots away from being known primarily for delivering milk. His vision is both practical and surprisingly energizing: a service-obsessed, cold-chain-capable distributor with a differentiated product mix—built for the needs of grocery stores and convenience stores across Minnesota and Wisconsin.

And he’s clear-eyed about the work ahead.

“We need to re-assure customers that we can be there for them.” — Joe Pettit

This is the article people tend to enjoy most about businesses like Polka Dot: not a glossy brand manifesto, and not a raw Q&A—but a feature story built around one theme (showing up), using direct quotes as evidence, and grounded in the real operational choices that determine whether a hometown company thrives.

What follows is that story.

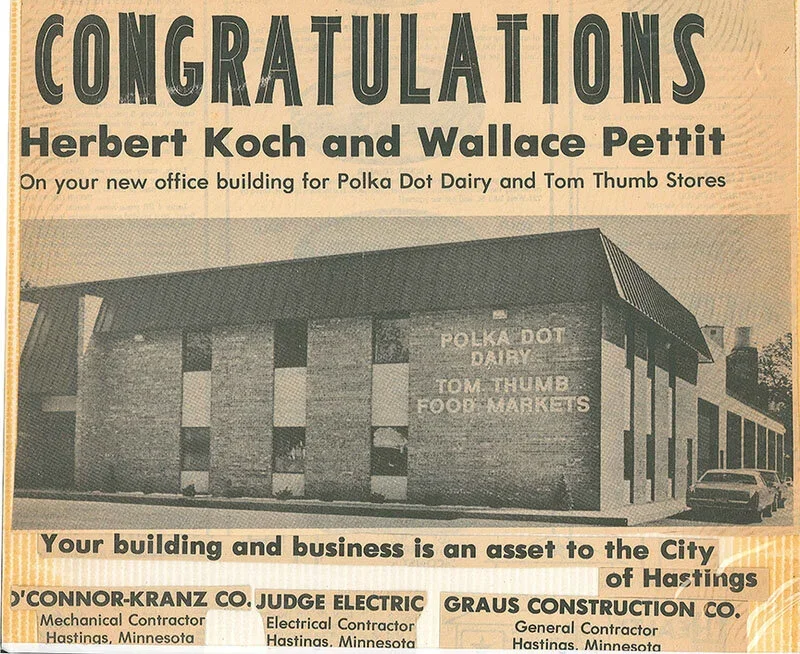

Polka Dot Dairy has stood as an iconic landmark in Hastings, Minnesota, serving the community with quality dairy products since 1957.

The headline isn’t “milk.” The headline is “service.”

Polka Dot Dairy’s own “Visual History” reads like a classic Hastings success story: a small, family-run distributor that grew over time, served the grocery and convenience market in Minnesota and western Wisconsin, and built a reputation around fundamentals—quality, fair pricing, and service.

Even today, the company still explains its customer experience through a direct-store-delivery style approach:

Delivery personnel serve as the main point of contact

They assist with product rotation and inventory control

In many cases, they help with ordering and stocking

And if a store has a real emergency?

Polka Dot’s policy is unusually plainspoken: special deliveries are not charged if they can accommodate—and if a driver error created the issue, they guarantee a special delivery.

That’s not “marketing copy.” That’s a business model built on accountability.

Joe Pettit’s interview frames the same idea in a modern, post-COVID service landscape:

“I say this a lot, but I find it very true in the post-COVID service world: ‘You’re a hero if you just show up’.”

It’s a short sentence with a lot inside it—because it implies a standard. In distribution, nobody thanks you for showing up when everything is easy. You’re measured on the days when it isn’t.

The disruption that changed the local dairy conversation

To understand why Joe is so focused on clarity, reassurance, and a differentiated product strategy now, you have to understand what happened to the local dairy ecosystem in 2023.

Polka Dot Dairy had a long-standing relationship with Hastings Creamery (described in the company’s own communications as going back to 1956), and in September 2023 Polka Dot published a detailed update explaining supply changes after the creamery closure—including new sourcing from other regional suppliers and product mix changes affecting milk formats and brands.

Meanwhile, public reporting painted a broader picture of why the Hastings Creamery shut down: regulators disconnected the facility from the sewer system after incidents and wastewater violations, and the closure landed amid difficult dairy economics and processor constraints for farmers.

Different stakeholders emphasize different causes. What matters for stores is what happens next: when a key part of the supply chain disappears, the downstream partners—distributors, retailers, and customers—feel the shock.

Joe Pettit doesn’t pretend it was clean or simple. He describes it as a major factor that pushed Polka Dot to reevaluate fluid dairy distribution, while also emphasizing that Polka Dot didn’t “quit” in the moment.

“The closure of the creamery absolutely influenced our decision to stop distributing fluid dairy products, but we didn’t ‘quit’ overnight. It should be proof of our resilience and determination that we DID NOT stop servicing our customers in the immediate aftermath of the creamery’s closing.”

Polka Dot’s 2023 “Next Chapter” post similarly framed the period as one of inventory and availability challenges amid supplier transitions, while reiterating commitment to maintain quality and service.

But Joe points to something even more fragile than inventory:

the story customers told themselves.

The Hastings Creamery shutting down forced Polka Dot to reevaluate its fluid dairy distribution strategy and adjust logistics.

“We’ve largely botched the storytelling”—and why that matters

A lot of businesses avoid admitting this publicly. Joe didn’t.

“This is a tricky one, because we’ve largely botched the story-telling on this point until now. MANY customers took our message that we were not going to sell milk any more as ‘Polka Dot is going out of business’.”

In a small-to-mid-sized service radius, perception travels fast. A single misunderstood message can trigger:

retailers quietly switching vendors

long-time accounts “just to be safe”

vendor hesitation

recruiting challenges (“is this stable?”)

Joe’s priority now is to reverse that narrative with truth:

“We need to re-assure customers that we can be there for them.”

That reassurance isn’t a slogan. It’s operational proof.

The name stays: Polka Dot is still Polka Dot

Polka Dot’s identity is iconic in the region because it’s attached to a feeling: local, familiar, dependable. It’s also attached to a standard the company repeats across its own history: quality products, fair prices, outstanding service.

Joe’s view is that the brand’s meaning can expand beyond the creamery era without losing its core.

“The name will stay the same. While it used to represent high quality dairy products produced at the creamery in Hastings, it now will reflect on our father’s and family’s commitment to service and relationship-building with our customers.”

This is an important leadership move: it reframes Polka Dot’s brand equity from “milk” to something broader and more durable:

relationships + execution.

It also aligns with Polka Dot’s own public identity as a small, family-owned company focused on long-term customer relationships and a model that allows customers to interact directly with ownership.

The realistic geography: a disciplined 75–100 mile radius

A subtle but powerful part of Joe’s interview is what he doesn’t do.

He doesn’t claim Polka Dot will “take over the Upper Midwest.” He doesn’t overpromise.

“Understanding the delivery radius is important. We are nowhere near to effectively servicing the ‘upper Midwest’. But a 75-100 mile radius of Hastings is somewhat reasonable.”

That’s the voice of someone thinking like an operator, not like an ad agency.

In route-based distribution, density matters more than bravado. A disciplined radius can mean:

better on-time performance

cleaner communication

fewer missed stops

better cold-chain reliability

more time for in-store service

And in Polka Dot’s world, service is the point.

The differentiator: refrigerated + frozen capability

Joe describes a key competitive advantage plainly:

“Having refrigerated and frozen delivery capacity sets us apart from many competitors.”

That’s not a small detail—especially for the grocery and convenience store categories that are winning right now:

ice cream and novelties

frozen pizza and quick meals

premium snack cheese and meat snacks

regional items that require temperature control

Polka Dot’s site reflects this broader product storytelling direction through a growing Vendors section—long-form spotlights that speak directly to what retailers need: items that stand out, move fast, and earn repeat purchase.

The product strategy: “not a carbon copy”—and a lane to own

When distributors struggle, they often respond by trying to be everything.

Joe is explicitly choosing the opposite.

“We will source quality products that not ALL DSD and ‘Broad-line’ vendors have. We will continually look for products to add to our repertoire.”

That’s a clear positioning statement. It says:

Polka Dot is not trying to mimic big broadliners

Polka Dot wants items that create incremental sales

Polka Dot is willing to keep evolving the mix

He also names a lane Polka Dot can own:

“Our core items remain beef- and cheese-based… I have always thought that we could be THE JERKY GUYS…”

That phrase is memorable because it’s specific. And in 2025 retail reality, specificity wins. Convenience stores and independent groceries don’t need another distributor with the same set. They need a partner who can help them win a few high-margin categories decisively.

Joe’s interview lists “legacy” lines the team remains excited about—alongside newer brands they see momentum in:

Core/legacy excitement (per Joe):

Blue Bunny Ice Cream and Frozen Novelties

Husnik Meat Snacks

Old Trapper Beef Jerky

Werner Gourmet Smoked Products

Von Hanson’s Seasoned Pretzels and Crackers

Country Fresh Meat Snacks (with possible opportunity as DSD models change)

Newer excitement (per Joe):

Glenwood Beef Jerky

Ranch House Beef Snacks

Tejanita Hispanic Ice Cream

Square One Lumberjack Pizzas and Frozen Entrees

Polka Dot’s vendor storytelling already reflects several of these categories and brands, and it explicitly positions the company as a distributor helping retailers across Minnesota and Wisconsin stock products in “roughly 200 cities.”

The service strategy: show up, answer the questions, don’t overpromise

If Joe has a central operating philosophy, it’s this: service doesn’t need to be flashy—it needs to be dependable.

“We plan to continue our outstanding service commitment, but often just living up to customer’s expectations can be ‘outstanding service’.”

He then defines what customers actually want:

“We need our customers to feel that their questions (‘is what I want in stock?’, ‘when is our order coming?’) are being answered, and that their needs will be met.”

And he draws a clear line that protects trust:

“It is also imperative that we don’t over-promise; that we communicate what we can and cannot do clearly.”

That aligns with the company’s broader public positioning—DSD support, special deliveries when possible, and a model built around direct relationships.

In other words: Polka Dot’s future isn’t “new.” It’s the same service ethos applied to a broader, more resilient product portfolio.

The quality strategy: “hands-on,” story-driven, and disciplined about freshness

A company can’t pivot product mix without protecting quality. Joe describes how Polka Dot thinks about that in everyday terms:

“We are very hands-on with our products. We frequently snack on our inventory (haha) and really don’t bring on products that our sales associates don’t feel good about selling.”

Then he points to a more operational quality discipline:

“We closely monitor the expiration dates on our inventory as it arrives, thereby ensuring that we are selling products to our customers that have sufficient time for them to sell them with maximum freshness.”

That fits the kind of distributor Polka Dot has historically described itself as: quality-driven, relationship-oriented, service-forward.

He also notes something vendors sometimes underestimate:

“We try to learn our vendors’ ‘stories’ about what makes them different from lesser competitors.”

This is more than marketing. In a convenience store or small grocery, the story behind a product helps it earn shelf space—and helps staff recommend it. A distributor that can translate a product story into sell-through is a distributor that vendors remember.

Pictured: A Polka Dot Dairy truck delivering in South Minneapolis. At Polka Dot Dairy, showing up is the norm.

The technology strategy: not “novel,” just necessary

Joe’s most obvious growth lever isn’t a new warehouse or a flashy rebrand. It’s clearer communication through practical technology.

“I think the most obvious opportunity is to use technology (not necessarily novel) to better communicate our offerings to existing and potential customers.”

He describes a specific, retailer-friendly improvement:

“Having online ordering through our website with images of the products so customers know that they are ordering the right product would be a huge step forward.”

That’s not small. Product confusion causes errors, returns, frustration, and lost shelf time. In the next chapter, better digital clarity becomes part of “service.”

The content strategy: vendor stories, retailer spotlights, and a fresher heartbeat

Polka Dot’s website already frames its News section as a place to “share what makes Polka Dot Dairy special, right from the heart of Hastings, MN.”

Joe is thinking about how to keep that alive—without making promises the team can’t sustain.

“I like the idea of ‘news’ or ‘stories’ section, the trick is to update it continually and keep it fresh.”

Then he offers a realistic cadence:

“Perhaps committing to a monthly new or even existing product profile / video / visit / interview with the vendor would be a cool idea.”

He also floats two ideas that are quietly powerful for community and recruiting:

“Profiles of retailers that sell a lot of our items may be a cool idea, as well.”

“Profiling our staff may also be a good idea, maybe have them talk about what products they like etc.”

This is exactly how a local distribution brand becomes visible again: not through hype, but through consistent stories that make the work feel real.

The community strategy: Hastings first, even when the footprint is regional

Joe makes it clear that Polka Dot’s roots aren’t branding—they’re responsibility.

“We have been a key employer in Hastings since 1956, although we are much smaller now.”

He also describes ongoing community support, including donations of inventory and holiday-season support for Hastings Family Service.

Whether a reader is a retailer, a vendor, or a job seeker, that matters. It signals a company trying to stay local in a world that often pushes consolidation.

What this means for retailers (grocery stores and convenience stores)

This is the practical “so what” of Joe’s interview:

Retailers can expect Polka Dot to lean harder into:

reliability and communication (the basics that keep stores sane)

cold-chain categories (frozen + refrigerated sets that drive repeat purchase)

differentiated items that broadliners don’t always prioritize

a service culture that believes “showing up” is the standard, not the exception

And retailers can reasonably expect Polka Dot to keep treating service as an in-store discipline—not just a delivery. That’s consistent with Polka Dot’s published DSD model: rotation support, inventory control, and assistance with ordering/stocking in many cases.

What this means for vendors (especially Midwest brands)

If you’re a vendor reading Joe’s interview, it’s an invitation with clear criteria:

Polka Dot is looking for products that are:

quality-first and easy to believe in

not everywhere already

appropriate for a 75–100 mile Hastings-centered service radius

compatible with refrigerated/frozen delivery when needed

supported by a story that makes the product easier to sell

And if you’re the kind of vendor who values storytelling support, Polka Dot’s current vendor content direction shows intent: their vendor feature posts are written for retailers and shoppers, emphasizing what makes products stand out and how Polka Dot helps those products reach stores.

What this means for job seekers (and why this is a real moment to join)

A pivot can be destabilizing—or it can be a rare chance to join a company while it’s rebuilding with purpose.

Polka Dot’s Jobs page is straightforward about what it’s hiring for and what it offers: CDL drivers, a stated starting salary of $63,000, home most nights, no weekends, and benefits including health/dental, 401(k) match, product discounts, and quarterly bonuses.

Just as important is the cultural cue:

Polka Dot describes itself as a “small family-owned and operated business” with a “friendly, family-type work environment.”

In Joe’s words, the modern service world is full of excuses. Polka Dot’s bet is that there are still people who want to win by doing the basics exceptionally well.

The simplest way to summarize Joe Pettit’s vision

If you had to boil the interview down to a few lines, it’s this:

Polka Dot isn’t going away. It’s evolving.

The name stays. The meaning expands from “milk” to “service + relationships.”

The footprint stays disciplined (75–100 miles from Hastings) so service stays real.

The product mix becomes more distinctive—especially in jerky/meat snacks, cheese snacks, and frozen.

Technology and storytelling become service tools, not vanity projects.

Transparency becomes a strategy: don’t overpromise; answer the questions.

That’s not a reinvention. It’s a refocus.

FAQ

-

Yes. Polka Dot Dairy lists its location in Hastings and continues to emphasize service and delivery to grocery and convenience stores in Minnesota and western Wisconsin.

-

Joe Pettit says many customers interpreted the shift away from milk as “Polka Dot is going out of business,” and he describes this as a storytelling challenge the company is actively correcting.

-

According to Joe Pettit, the focus is a differentiated product mix (especially beef- and cheese-based snacks), supported by refrigerated and frozen delivery capability, disciplined geographic coverage, and better technology for ordering and product visibility.

-

Polka Dot’s Jobs page advertises CDL driver hiring with pay, schedule, and benefit details.

-

Joe Pettit says Polka Dot wants quality products not carried by all DSD and broadline distributors, and the company’s vendor storytelling suggests a strong fit for differentiated regional brands—especially in snack and freezer categories.